Financial Planning for

Retirement Goals

Unexpected Events

Identifying Risk

Planning a Legacy

Life

Welcome to PB White & Co.

Prudent, personal, objective, independent, and comprehensive financial planning and advice.

For three generations, we have positioned our client’s financial goals and well-being as the primary drivers of our success. We begin every client relationship by seeking your answers to the following two questions:

- What do you hope to accomplish?

- What is important to you?

PB White & Co. strongly adheres to five core planning areas: Investment Advice and Management, Tax Analysis, Estate Planning, Insurance, and Retirement Planning. We also apply sophisticated financial modeling techniques using state of the art technology to quantify and substantiate our recommendations.

Building the Life You Love

Financial Planning

Investment Advice

Risk Management

Estate Planning

Tax Planning

Retirement

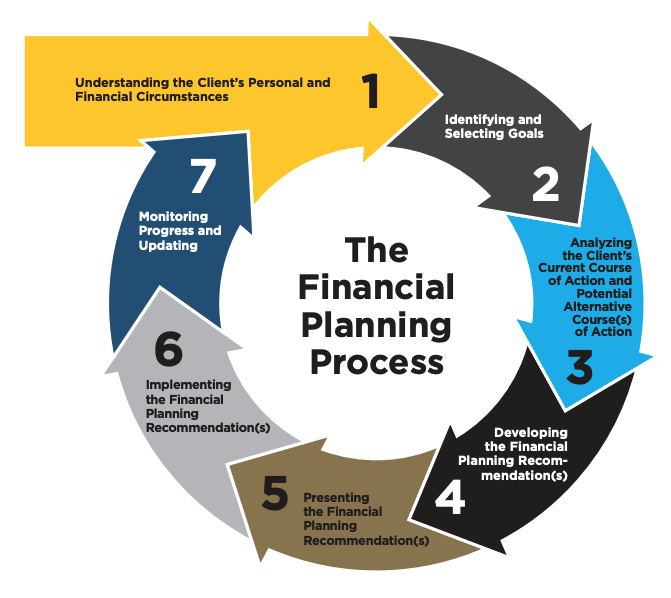

CFP 7-Step Process (Source)

A Proven Process

As fiduciaries, we have a duty to provide information, document and act in the best interest for each client.

PB White & Co. strongly adheres to the CFP Board’s 7-step process of financial planning which focus on getting to know the client’s current financial situation and goals and end with continually measuring performance toward those goals and updating them as necessary.

We also apply sophisticated financial modeling techniques using state of the art technology to quantify and corroborate our recommendations.

Founded in 1959, Phillip B White & Company has been building deep and long lasting client relationships for over 60 years. We earn client trust and confidence by providing peace of mind through prudent, personal, objective, independent, and comprehensive financial planning and advice. We believe the most effective means to creating and preserving wealth is through consistent and on-going financial planning working with a dedicated and experienced team. PB White & Co. is a Registered Investment Adviser (RIA), has fiduciary duty to the client, and is compensated on a fee basis. For three generations, we continually place client’s financial goals and well-being as the primary drivers of our success.